Weekly Passive Income Guide: Smart Yield Plays for June 2025

The DeFi landscape continues to offer compelling yield opportunities for investors looking to put capital to work without constant portfolio babysitting. This week's guide highlights several protocols with strong risk-adjusted returns and upcoming catalyst events that deserve attention.

Top Yield Opportunities This Week

Huma 2.0 Reopens Deposits (June 10)

After hitting capacity limits in its first phase, Huma Finance will reopen deposits on June 10 at 10:00 UTC. HUMA stakers get priority access starting 24 hours earlier.

The setup:

Deposit allocation tied to HUMA staking (1 HUMA = $0.04 deposit limit)

Season 2 airdrop confirmed at 2.1% of supply (vs 5% for Season 1)

RateX LP strategy still viable for double-dipping

Why it matters:

Huma's first season participants did exceptionally well with the initial token distribution. The reopening provides a clean entry for those who missed the first wave, with a clear catalyst timeline for the Season 2 airdrop. The protocol has gained significant traction since its initial launch.

BounceBit's USD1 Incentives Launch (June 9)

BounceBit is pushing adoption of USD1 with an aggressive 15% APR incentive program launching today with a hard cap on total deposits.

The setup:

Deposits open June 9 at 19:00 Beijing time

$1M total capacity (expect quick filling)

15% APR for 30 days, no token lockups

Clean UI with straightforward deposit process

Why it matters:

This is essentially free yield with minimal strings attached. The limited deposit window and hard cap create scarcity, likely driving rapid uptake. Set an alarm - these allocation slots typically fill within minutes for incentive programs this generous.

Cove Protocol: $3M Raise with Clear Token Signals

Recently backed by Electric Capital and other prominent VCs, Cove's portfolio management protocol offers one of the clearest "deposit-to-token" pathways currently available.

The setup:

8.08% base APY on coveUSD deposits

Team explicitly confirmed token rewards for early depositors

1% management fee on deposits

Why it matters:

Electric Capital's involvement signals substantial upside potential given their track record. The management fee structure suggests targeting this for 3+ month horizons to fully capitalize on the inevitable token launch. This looks similar to early Sommelier, which delivered exceptional returns for early LPs.

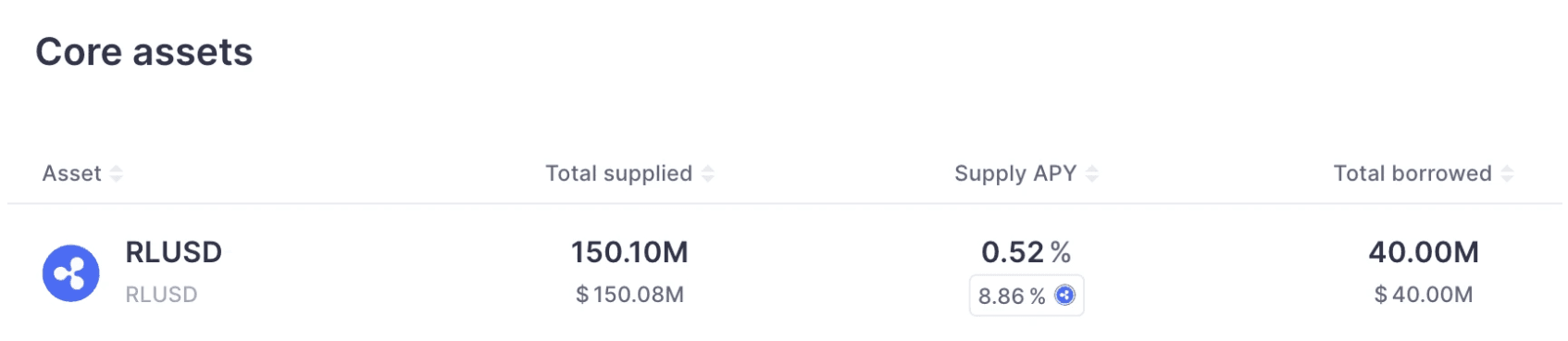

Ripple's RLUSD: Corporate Giant's DeFi Play

Ripple is making a serious push into DeFi with its RLUSD stablecoin, offering substantial incentives for Aave depositors.

The setup:

9.38% total APY on Aave (8.86% incentives + 0.52% base)

Rewards paid directly in RLUSD

Zero lockups or complicated strategies required

Why it matters:

This represents institutional capital subsidizing retail yields to gain market share. Ripple's regulatory clarity post-SEC settlement makes this one of the safer yield plays in the current environment. The strategy requires nothing beyond a standard Aave deposit with boosted returns.

InfiniFi: Electric Capital's Other High-Conviction Bet

Electric Capital is betting big on yield aggregation, with InfiniFi representing their second major play in this vertical this year.

The setup:

11.25% base APY, scaling to 22.64% with 8-week lockup

Points program active with clear token intent

Whitelist/referral code required for access

Why it matters:

The 8-week lockup tier represents one of the highest risk-adjusted yields available right now. The dual rewards structure (yield + points) resembles early Morpho, which delivered 10x on early deposits. The whitelist restriction creates artificial scarcity that typically precedes substantial token upside.

Other Noteworthy Developments

Avantis Secures $8M Series A from Thiel & Pantera

Base ecosystem DEX Avantis just closed an $8M Series A led by Founders Fund (Peter Thiel) and Pantera Capital, with Symbolic, SALT and Flowdesk participating.

The setup:

Low-risk LP vault yielding 5.73% APR (base rate)

Lockup tiers boost returns to 20.5%

Second season points campaign running

The angle:

The involvement of traditional venture heavyweights signals institutional confidence. Avantis isn't new, but the fresh capital injection and current point campaign make this an opportune entry timing for those who haven't participated yet. LP structuring mitigates typical impermanent loss concerns.

Sky Introduces Stablecoin Rewards for Stakers

Sky (formerly Maker) has implemented USDS rewards for SKY stakers, creating interesting neutral strategies.

The setup:

SKY staking currently yields 15.96% in USDS

Position can be hedged via MKR shorts

Enables delta-neutral yield farming

The angle:

For sophisticated players, this creates one of the cleanest delta-neutral setups available. The fixed SKY/MKR redemption ratio provides a natural hedge mechanism for those looking to isolate the staking yield without directional exposure.

Yield Strategy Comparison

| Protocol | Base APY | Max APY | Token Upside | Lock Period | Capital Efficiency |

|---|---|---|---|---|---|

| Huma 2.0 | ~5% | ~8% | High (Season 2) | None | Medium |

| BounceBit | 15% | 15% | Unknown | 30 days | High |

| Cove | 8.08% | 8.08% | High | None | Medium |

| RLUSD/Aave | 9.38% | 9.38% | Low | None | Very High |

| InfiniFi | 11.25% | 22.64% | High | Optional | Medium-High |

| Avantis LP | 5.73% | 20.5% | Medium | Tiered | Medium |

| Sky/MKR | 15.96% | 15.96% | None | None | Low (hedging) |

Execution Strategy for This Week

If capital deployment is the goal this week, here's the optimal sequencing:

Today (June 9): Set alarms for BounceBit USD1 deposits opening at 19:00 Beijing time

Tomorrow (June 10): Prepare for Huma reopening - HUMA stakers should access at 18:00 Beijing time (24h early)

After securing allocations: Distribute remaining capital across Ripple's RLUSD strategy (for safer allocation) and InfiniFi's 8-week tier (for higher returns)

For larger portfolios: Consider a Sky staking + MKR short position sized at 10-15% of total capital

The beauty of this approach is the minimal maintenance required after initial setup. Most of these positions require attention only at maturity or when specific catalyst events occur.

Final Thoughts

The current yield environment represents a sweet spot where institutional capital is subsidizing retail yields to gain market share and protocol adoption. These opportunities typically shrink as markets mature, so capitalizing on them while maintaining appropriate risk management makes sense for most portfolios.

Smart players will diversify across several of these opportunities rather than concentrating in any single protocol, regardless of how attractive the headline rates appear.

This guide represents personal research and opinion, not financial advice. Smart contract risk always exists in DeFi - size positions accordingly and never deploy capital you cannot afford to lose.

For reliable trading infrastructure to access these opportunities, WEEX provides institutional-grade exchange services with deep liquidity pools across major pairs.

You may also like

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…