Larry is Farcaster's silver shovel?

Recently, innovations in asset issuance methods on Base have continued to emerge: "Can you really play Base Clanker?", many new products have emerged in the community, and Larry is one of the most distinctive ones.

At 12 noon on December 5, David Fulong (@df), senior developer of Farcaster and founder of Frame protocol, published a cast, announcing the birth of Larry.

Team background: Larry vs Clanker

Clanker was founded by @_proxystudio and @JackDishman, and Larry was founded by @davidvfurlong and @stephancill.

Farcaster veteran player @0xLuo popular science: Clanker's founding team is a new developer of Farcaster, Larry's founding team is Farcaster OG, @davidvfurlong's resume is particularly impressive: his company has received investment from A16Z (note that A16Z did not invest in Larry), and he himself is also the proposer of the Frame protocol - Frame is a major innovation of Farcaster, and it is also the key to the Farcaster team's ability to get $150 million "on the surface".

In contrast, Larry's team is more politically successful; but Farcaster's OG status is a negative buff for the publisher, after all, it is well known that Farcaster is a mosque...

From an operational perspective, Clanker does understand memes better. Its founder @proxystudio.eth often contributes various "god comments" to Farcaster, and Clanker's official account (@_proxystudio ) is also very funny:

On the other hand, Larry, maybe because it was just launched less than a week ago, the entire team's energy was completely focused on product development and mechanism design, and there was almost no support for ecological projects and operation of official brands and communities - this is an important reason why its leading token $LARRY (currently around 3M, up to 7M) lags far behind Clanker's leading token $CLANKER (currently around 50M, up to 150M) in market value.

Asset Issuance Mechanism: Larry vs Clanker

In a nutshell, Larry and Clanker are both AI Agents that issue tokens as soon as they post. Larry’s asset issuance method imitates Pumpfun’s internal and external pool mechanism, while Clanker’s asset issuance method is fair launch - the former’s shortcoming is that the threshold restricts retail investors from participating in the early stage, while the latter’s shortcoming is that it is difficult to overcome robot sniping.

Asset issuance mechanism: Clanker

Specifically, by tagging Clanker on Farcaster and stating the token name, ticker, and header image, Clanker can add a Uniswap pool with a starting market value of approximately $30,000 on Base for free (the threshold is that the Farcaster account Neynar score must be high enough, which means it is difficult for newcomers to issue tokens). All deployed tokens can be viewed on the official website.

Unlike PumpFun, which charges 1% transaction fee + 2 Sols on Raydium fee during the bonding curve, Clanker does not have a bonding curve, but charges 1% handling fee from Uni v3 as income: 40% to the issuer and 60% to the Clanker team - this split ratio may change, see official documentation for details.

Asset issuance mechanism: Larry

Like Clanker, Larry also issues tokens by posting with a threshold limit.

After receiving the message, Larry AI Agent will initiate an internal market on its official website Larry.club : The latest rule is that the upper limit of the internal market fundraising time is changed to 69 minutes, each person can put in a maximum of 0.25E, and all people can put in a total of 3E. After it is full, it will wait for a while before adding a pool to open on V3. (Previously it was 15 minutes and over-subscription was allowed)

The specific details are that a launch button will appear on the page, and then an internal user is required to confirm and pay the gas fee (Note: the dev sold displayed on GMGN is actually the user who clicked the launch button, not the real developer...)

A very criticized point in the whole mechanism is that the neynar score needs to be higher than 0.8 to fill the internal plate, and ordinary retail investors can't get in at all. They can only watch Farcaster OGs fill the internal plate and then take their chips on the external plate - in fact, they can understand the intentions of the mechanism designers: after all, this is an era where whoever has the bottom chips is the dealer, and the team hopes that the "dealers" will cherish their feathers and not smash them as soon as the market opens - but the reality is: many plates on Larry are drilled into the ground in 10 seconds, because people on the internal plate know how bad the experience of people on the external plate is. If the angle is not tricky enough, no one will come to take it, thus forming a stampede on the internal plate...

Currently The voice of FUD Larry tokens is dominant. Apart from the leading $LARRY, no other token can survive the second wave of drilling, let alone take off like $ANON $CLANKER $LUM on Clanker... (For the launch of various tokens on Larry in the past few days, see this tweet)

But it’s still early days, the mechanism design may change at any time, and the team is also constantly thinking about how to best couple the internal mechanism with the real-name PVP Socialfi game - let us continue to observe. (For a more detailed comparison between Clanker and Larry, see this tweet.)

Larry’s development history: from drilling into the ground to V-reversal

BUG storm: explosive pull and then drilling into the ground

Open the candlestick chart of $LARRY, you will find that it pulled up on the first day, and then continued to drill into the ground for the next two days.

(Note again: the dev sold shown on GMGN is actually the user who clicked the launch button, not the real developer)

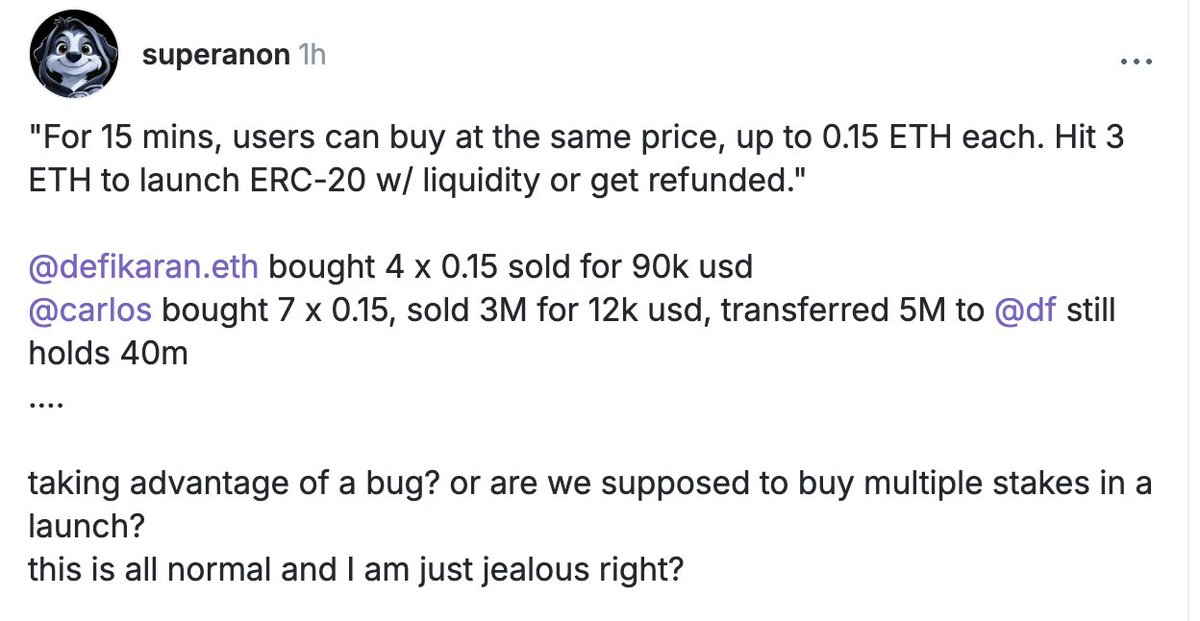

Why? The most important reason is that Larry's software crashed at the beginning. On the one hand, it could not issue coins. On the other hand, it was caught in a public opinion storm that the software had a bug and introduced internal insider trading: An anonymous person claimed that two participants used 0.6 ETH and 1.05 ETH at the bottom to sell when the market was rising, and each earned 90k and 12k...

The founder @davidvfurlong admitted the software bug and apologized, and then fixed the vulnerability. He also kept fixing bugs for the next two days, which was quite embarrassing: the coin price plummeted all the way, from a high of 7M to less than 1M...

Continuous construction: drilling is rising again

BUG After repairs and mechanism optimization, the K-line of Drilling has risen again, and is currently fluctuating between 2M and 4M.

Two days ago, the founder @davidvfurlong did another big thing: he released a Farcaster AI template as an open source for later developers to quickly deploy AI Agents on Farcaster, which led to a series of AI Agents interacting with Larry, including the dqau (the corresponding token is @freysa_ai "man-machine game" story that went viral on Twitter) reproduced on Farcaster.

Where is Larry's future?

The editor observed the community and found that the evaluation of Larry by community members can be summarized in eight words: "Sorry for his misfortune, angry at his lack of competition."

"Sorry for his misfortune" means that Larry's release did not cater to the right time: on the day of Larry's release, Clanker was making a fortune and was in the limelight; in addition, the liquidity of the Farcaster ecosystem was far from sufficient for people to chase the second dragon; and who would have thought that the products of the two super developers would have a lot of bugs as soon as they went online - the leading token $LARRY and its ecological tokens were continuously suppressed, and many "precious angles" were wasted...

"Angry at his lack of competition" means that Larry's team is too pure, does not know how to make things, and more importantly, does not know how to make markets - this is actually a common problem of all Farcaster tokens.

This wave of memes is a key step in the process of Farcaster's de-halalization. People will gradually flock in: from the lone P players to the real dealers, who can only pull up the lever to bring about a flood of money - I hope this day will come soon.

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Solana Loses Major Portion of Validators as Smaller Nodes Exit: Concerns Over Centralization

Key Takeaways: Solana has experienced a significant drop in active validators from a high of 2,560 in March…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…